Rising Policy Uncertainty Leads to Increased Market Volatility

This edition recaps rising policy uncertainty and renewed trade tensions, which fueled early-month market volatility, leading to a sharp selloff before equities partially rebounded.

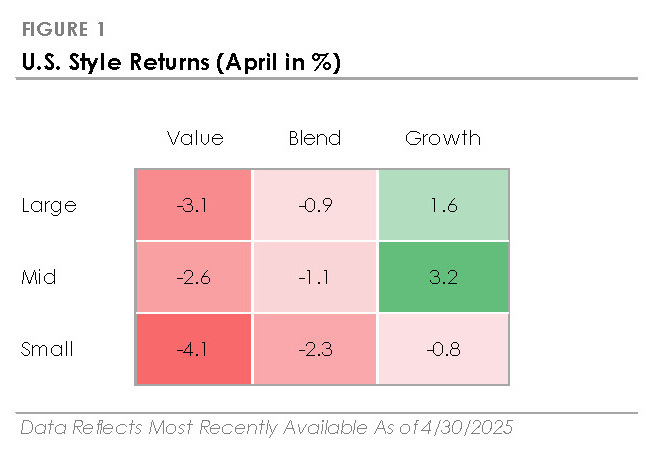

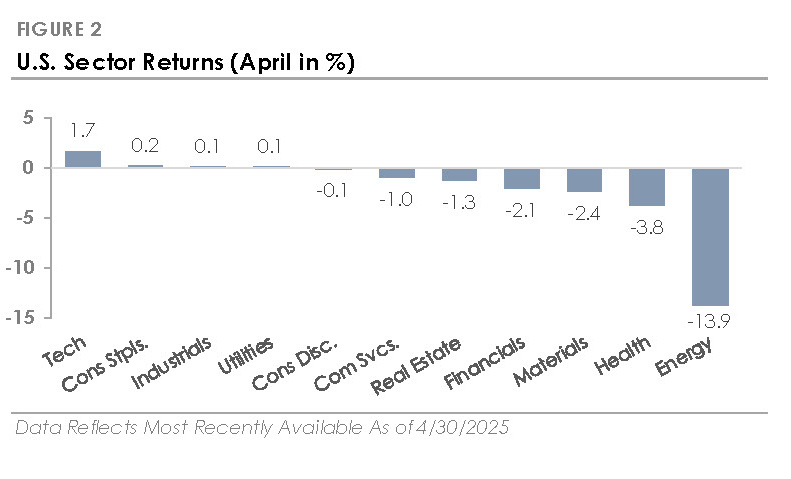

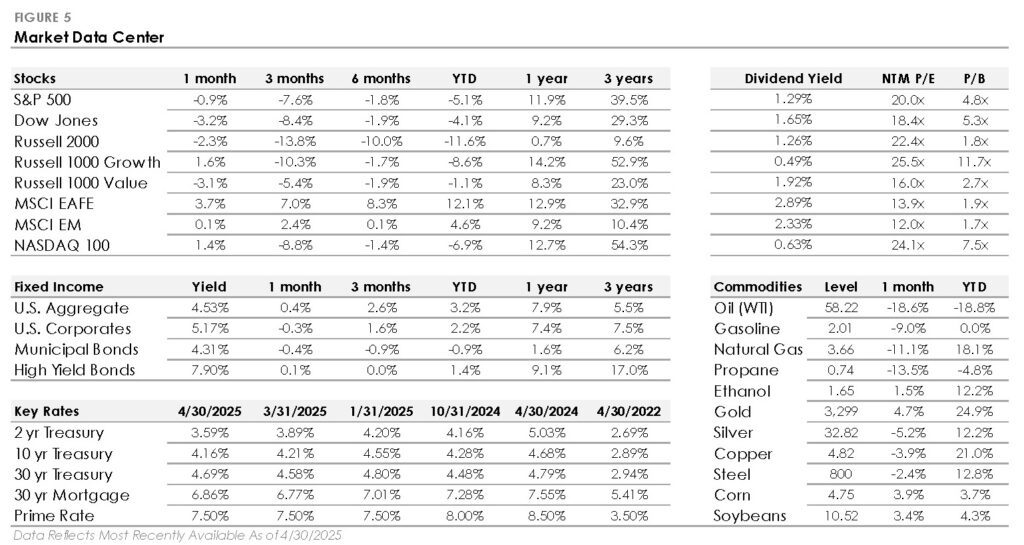

- The S&P 500 Index returned -0.9%, outperforming the Russell 2000 Index’s -2.3% return. Technology was the top-performing S&P 500 sector, followed by Consumer Staples, Industrials, and Utilities. Energy returned -13.9% as oil prices fell -18.6%.

- Bonds ended the month unchanged despite intra-month volatility, with the U.S. Bond Aggregate posting a +0.4% total return. Corporate investment-grade bonds produced a -0.3% total return, underperforming corporate high-yield’s +0.1% return.

- International stocks traded higher and outperformed the S&P 500. Developed Markets gained +3.7%, while Emerging Markets returned +0.1%.

Markets Rebound from an Early-Month Selloff as Trade Tensions Ease

Stocks declined in early April after the White House unveiled sweeping tariffs, with the S&P 500 falling over -10% in the first week. However, after the administration paused tariffs and trade tensions eased, the S&P 500 rebounded to finish the month with a loss of less than -1%. Interest rates were volatile in April as the market navigated tariff headlines and economic uncertainty, but ultimately ended the month unchanged, with Treasury and corporate bond yields remaining flat. Outside the stock and bond markets, gold surged to a record high amid increased market volatility. Elsewhere, the U.S. dollar weakened due to concerns about the direction of U.S. policymaking. As discussed below, Washington policy has had a significant impact on global markets this year.

An Update on This Year’s Biggest Market & Economic Trends

This year’s major market trends have centered around a key theme: rising policy uncertainty. There’s been a notable shift in Washington policy, with the introduction of tariffs leading to increased caution among businesses and consumers. The uncertainty is impacting financial markets, which are focused on how tariffs will affect future economic growth and corporate earnings. Recent economic data indicates that tariffs pulled forward some consumer demand, but forward-looking surveys suggest growth could slow as policy uncertainty delays spending and investment decisions.

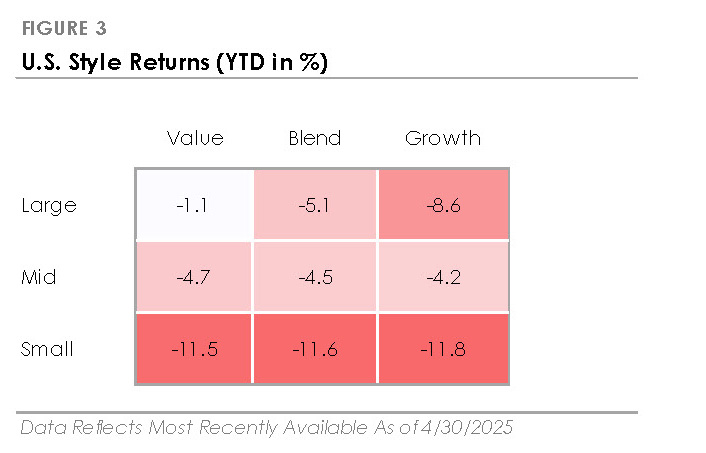

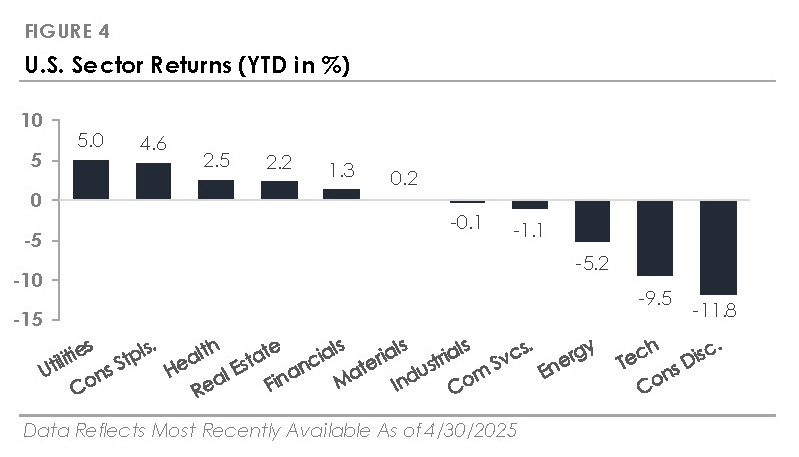

2025 has seen a significant change in stock market leadership. The Magnificent 7, a group of leading mega-cap technology stocks, is down over 15% year-to-date after gaining more than 60% in 2024. In contrast, defensive sectors are outperforming. Utilities, Consumer Staples, Health Care, and Real Estate have all traded higher this year, even as the S&P 500 is down 5.1%. Global stock market leadership has also shifted. International stocks outperformed the S&P 500 in Q1 for the first time since Q3 2023, marking one of their strongest quarters of relative performance since 2000.

The bond market is experiencing increased volatility, with Treasury yields moving sharply in response to developments in tariffs, fiscal debt concerns, inflation risk, and economic uncertainty. Corporate credit spreads, which tightened to 2007 levels late last year, have widened, causing high-yield bonds to underperform as investors price in the broader range of potential outcomes. Meanwhile, the Federal Reserve’s rate-cutting cycle remains on hold as it balances inflation with the potential for slower economic growth. The market is now forecasting four interest rate cuts in 2025, with the first cut expected in June.