Stock Market Surge

Stocks Rally as Market Leadership Shifts in Early 2025

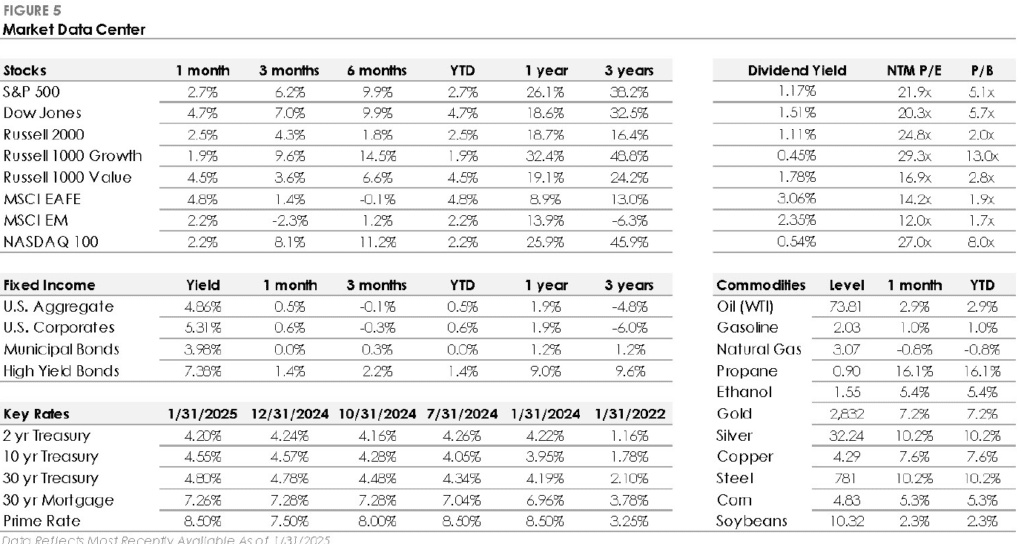

This edition of the Monthly Market Watch recaps key trends shaping early 2025. Stocks rallied, but market leadership shifted as Large Cap Value outperformed Growth for the first time in over a year. Meanwhile, AI-related concerns triggered a selloff in major tech stocks, impacting the S&P 500. High-yield corporate bonds outpaced investment-grade returns in the bond market, while international stocks saw mixed results. With evolving economic conditions and ongoing AI developments, investors closely watch how these trends unfold in the months ahead.

Stocks Trade Higher as Market Leadership Rotates After 2024’s Gains

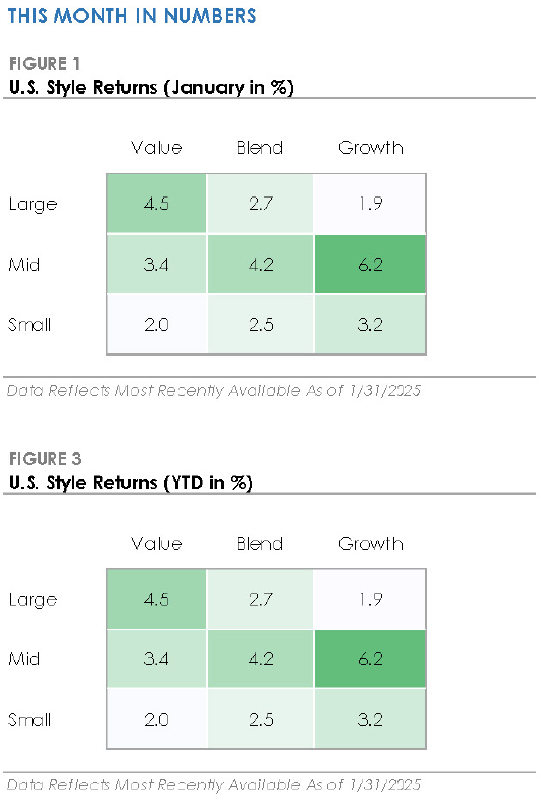

Stocks traded higher to start 2025, but there was a change in market leadership as the rally broadened. Large Cap Value, which underperformed over the past 12 months, outperformed Large Cap Growth by over +2.5% in January.

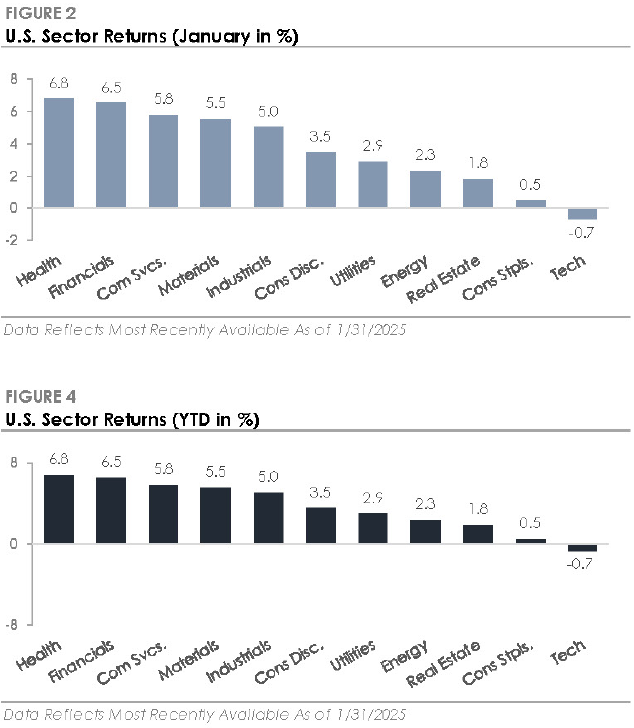

Likewise, the Dow Jones Index traded back toward its all-time high from early December after finishing the year in a downtrend. In contrast, the Growth factor, Nasdaq 100, and Technology sector each underperformed the S&P 500 after propelling the index higher throughout most of 2024.

The catalyst: AI-related news from China raised concerns about U.S. AI leadership and could have implications for broad U.S. stock market indices.

Technology Stocks Sell-Off After Chinese Startup Unveils Lower-Cost AI Model

In January, a major artificial intelligence (AI) development emerged with potential implications for both the industry and the U.S. stock market.

Chinese startup DeepSeek unveiled an AI model it claims can compete with top U.S. models, such as ChatGPT, but at a fraction of the cost. The model was developed using cheaper, less advanced chips, challenging the view that cutting-edge AI requires significant investment in high-performance, expensive hardware.

If other companies follow suit and develop lower-cost models, it could reshape the AI technology landscape and impact U.S. leadership.

DeepSeek’s AI model release triggered a selloff in U.S. tech stocks that had been boosted by AI growth prospects. The model’s lower development cost raised questions about the risk of reduced demand for the high-end chips used to train AI models.

The news was especially relevant for companies like Nvidia, a key supplier of high-end hardware favored by AI firms. Nvidia lost nearly $600 billion in market capitalization, one of the largest single-day losses for a U.S. company.

The selling pressure also extended to Microsoft, Alphabet, and Meta, reflecting broader concerns over the expensive valuations of AI-related stocks. While the news impacted a small subset of companies, the high weights of AI-related companies in the S&P 500 caused the index to trade lower on the announcement.

Given the S&P 500’s high exposure to AI stocks, the market will be closely monitoring developments in the AI industry in the coming months.