Treasury Yields Rise Following the Fed’s September Rate Cut

Monthly Market Summary

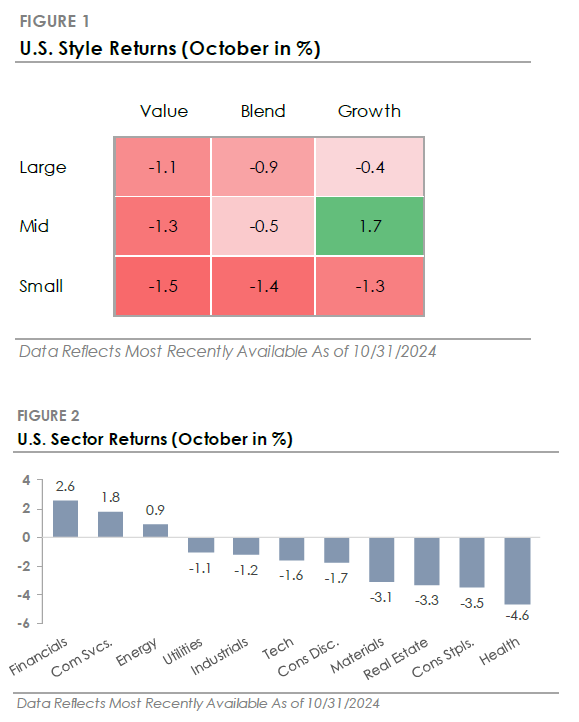

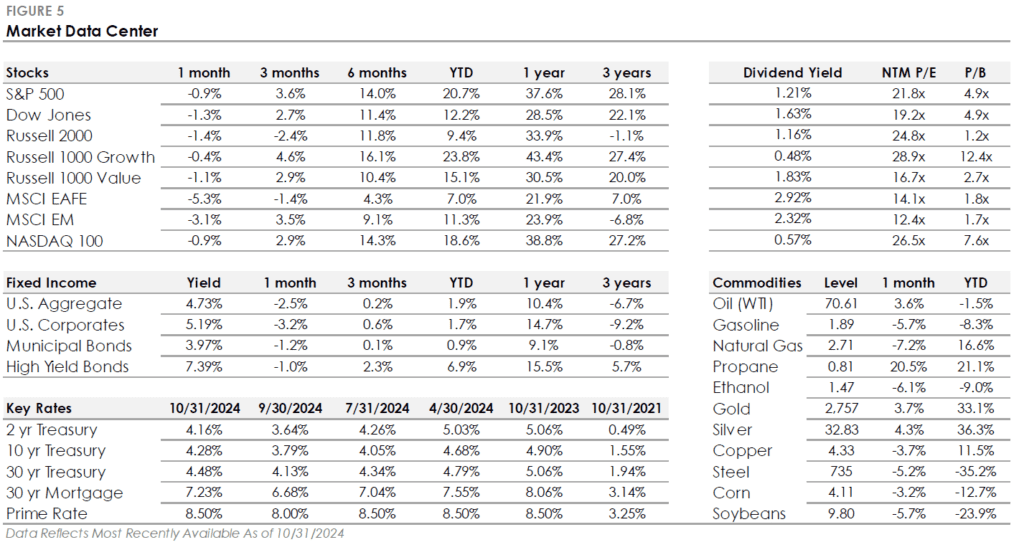

- The S&P 500 Index returned -0.9%, outperforming the Russell 2000 Index’s -1.4% return. Only three of the eleven S&P 500 sectors traded higher, with Financials and Communication Services both gaining more than +1.5%. The remaining eight sectors all traded lower by more than -1%.

- Corporate investment-grade bonds produced a -3.2% total return as Treasury yields rose, underperforming corporate high-yield’s -1.0% total return.

- International stocks also declined. The MSCI EAFE developed market stock index returned -5.3%, while the MSCI Emerging Market Index posted a -3.1% return.

Stocks End 5-Month Winning Streak with First Loss Since April

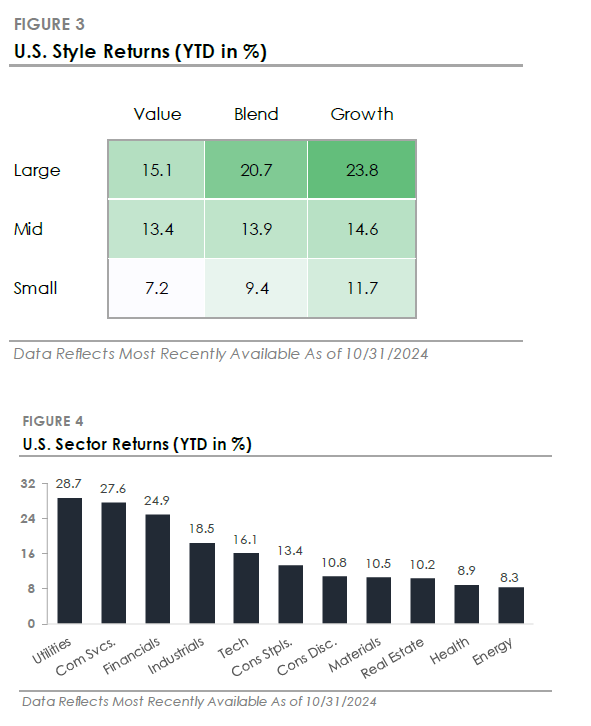

Stocks finished October lower as investors navigated Q3 earnings, the upcoming election, and uncertain Federal Reserve policy. The S&P 500 posted its first monthly loss since April, with large-cap stocks slightly outperforming small-cap stocks, though most investment factors had similar returns. In the bond market, Treasury yields climbed as investors weighed the likelihood of fewer interest rate cuts from the Fed and anticipated high fiscal spending. With these developments, bonds traded lower for the first time in six months.

Treasury Yields Spike After the Fed’s September Rate Cut

The bond market has been volatile this year. The 10-year Treasury yield began at around 3.90% and rose to 4.70% by late April due to early-year inflation. However, it reversed over the summer, dropping over -1.00% due to inflation decreases and rising unemployment. Following the Fed’s September meeting and a -0.50% interest rate cut, yields unexpectedly rose again, ending October at 4.28%, up by over +0.65%. The year’s swings in the bond market reflect volatile economic trends and uncertain Fed policy, with inflation and unemployment trends complicating interest rate decisions.

This Month in Numbers

Disclosures

Investment advisory services offered through Brookstone Wealth Advisors, LLC (BWA), a registered investment advisor and an affiliate of Brookstone Capital Management, LLC. BWA and Hoffman Financial Group, Inc. are affiliated companies under common ownership. Insurance products and services are not offered through BWA but are offered and sold through Hoffman Financial Group, Inc., GA Insurance License #163546. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

View All